Private equity investment opportunities keep getting better. What you hear in random conversations doesn’t begin to describe the complexity of its workings. After reading this guide, a beginning investor can always learn more about Brown Smith Wallace. There is a lot to explore, and that is a great starting point for curious minds.

What Is Private Equity?

Private equity is a stake in a private company that is selling at a value. It is the usual buy low sell high strategy, except with ownership stake taking the place of stocks. A private equity investment firm makes the smart decisions that grow that stake to a high enough amount so that it can be sold for a profit. Think of it as a money manager with great insight into the industry they’re trading in. Multiple sources can be used to raise the funds, so private equity remains less limiting than other trading options like public stocks and bonds.

There Is A Difference

Private equity is not the same as private business capital or venture capitalism. You are investing in a company during the growth stage, where there is a lot more opportunity to see a return on your initial investment. Three years of growth from a compatible company is exponential in value when you make the right investment choice. Instead of investing in a company that has yet to turn a profit, you are jumping into the prime years of their growth.

Finding The Right Fit

Now, this is what causes the biggest confusion with a beginner investor. Private equity firms each have their own strengths and weaknesses. With thousands of firms to choose from, the choice sometimes boils down to popularity. Everyone knows about the giants in the industry, so there is no need to mention them by name. Their billions of dollars invested in private and public businesses offer a large taste of flexibility for any investor. For the beginner, this may be a bit much. That is where smaller and mid-size firms come in to fill in the gap. You can further analyze the pull of a company by looking at the region or industry they operate in.

Understanding LPs And GPs

Limited Partners and General Partners provide the capital that firms use. The majority of the funds from this capital comes from LPs. The smaller remaining half is provided by GPs, but is just as important. With an LPs, a firm is usually pulling from banks, individuals, trusts and insurance companies. There are plenty of other capital sources with LPs, and they are all similar to those types.

With GPs, individuals are also tapped but are not high net worth individuals. A GPs will often have a history with the fund, and a strong background related to the industry they hold a stake in. Their importance shouldn’t be minimized since a GPs can source deals and balance communication between all parties.

Following The Money

Private equity deal sourcing can include other private equity firms. Investment banks and referral sources are also a big part of the sourcing process. Plenty of deals are explored, but only a few make the final cut. This is about a firm being efficient with its money and time and avoiding unstable stakes. Instead of it becoming a gamble, private equity investment focuses on getting the most out of all resources used. If a deal takes a while to materialize, then consider all of the moving parts behind the scenes.

Is This A Long-term Investment?

There are multiple sources for the funds, with some lasting over seven years before seeing a profit. Private equity is a process that takes years by default but is not considered a long-term investment. The longest period before divestiture is spent managing and improving the value of the stake. The second-longest period is the sourcing and closing of deals. With nothing guaranteed until closing, the sourcing/closing process can be the longest of them all. For every great opportunity that arises in private equity investing, there are several failed closing attempts.

A Compatible Choice

As mentioned earlier in the guide, an investment firm can be researched based on their region and industry of expertise. Something else to add to your research is the revenue range they operate at. This comes as a surprise to rookie investors when a firm is not interested in a particular business. Compatibility has to work both ways for the deal to be beneficial. Finding the right match is more than numbers, and at the very least requires a viable exit strategy. If your ambition for specific investments is beyond private equity investment, then consider where you want to be in a few years. Early deals aren’t attractive, but they set the groundwork for what your portfolio will look like.

There Is A Method To The Madness

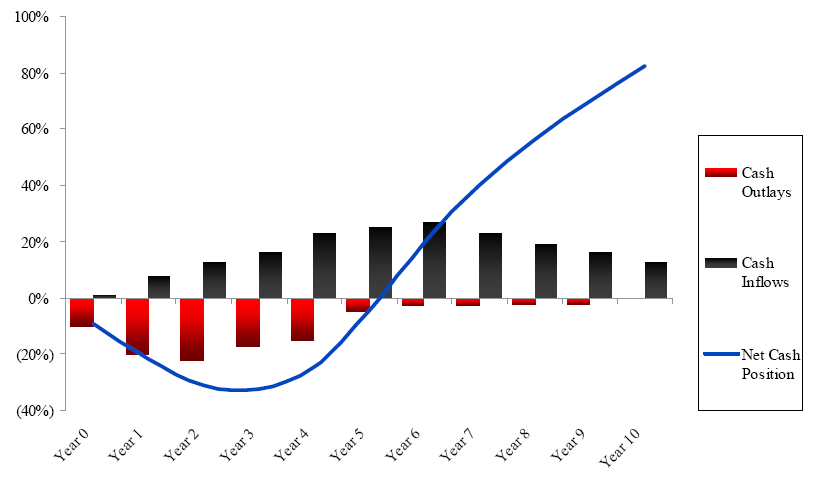

Buying private equity funds is never straightforward when discussing the finances of the deal. Many firms use debt to increase the rate of return. This is a large influence on closings, especially if the company is the right fit. The best way to understand how this type of investment works is to look at it in stages, and over several years. Seeing a purchase that is structured with up to fifty percent debt is not uncommon and works in your favor.

Yearly increases in equity are balanced out by a decrease in ownership debt. Based on the industry, this feeds into the rate of return, even if a company doesn’t grow after purchase. Now imagine having several of these deals in place. It is a low risk but high reward investment that requires the touch of a knowledgeable firm. The first year after closing will always tell you a lot about how well a deal is structured.

Wrap Up

Diversity is part of the game and remains a powerful mantra for investments. Private equity investments are another financial choice among many. By using all of the tools at your disposal, your portfolio will have more value. It is a win-win scenario where you retain full control while expanding your finances.